Introduction

Personal Finance is a modern concept of planning and managing personal or financial activities. It generally covers concepts such as income and spendings, savings, investments, insurance, etc. from individuals’ perspective. It is an application of financial concepts in financial decisions at an individual level at different stages of life. Personal finance involves analyzing financing options, home budgets, investment options, current account management, retirement plans, asset management, expenses management, etc.

The primary goal of personal finance is to empower each individual to have a strong, efficient and controlled financial position without any financial stress. It also allows individuals to have control over their financial decisions so that one can utilize the present finances to manage future opportunities or possible threats.

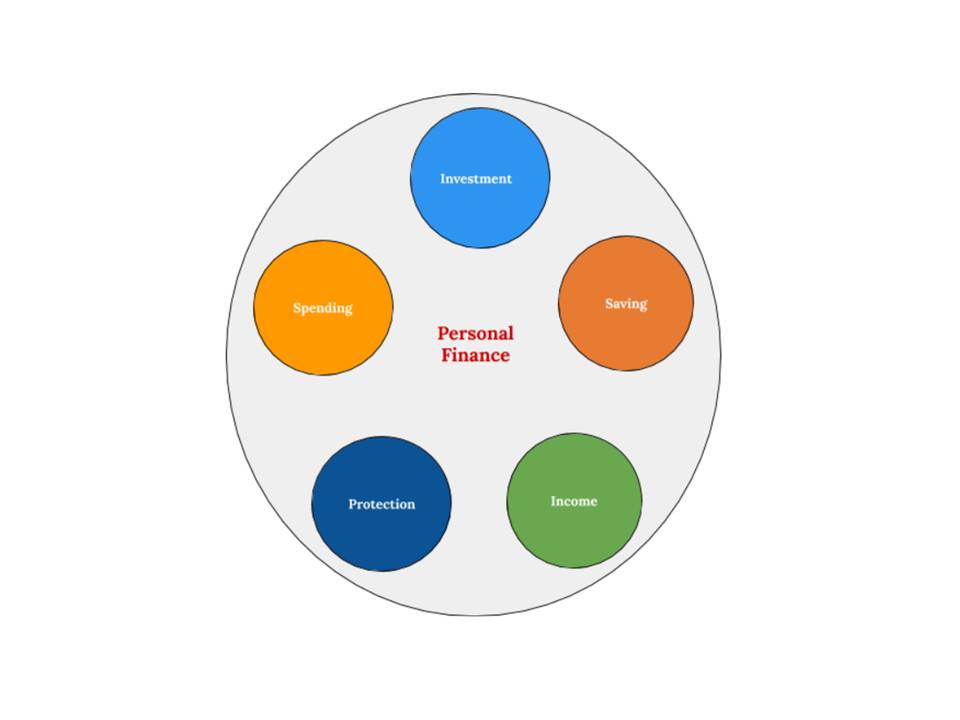

For better and more comprehensive understanding of the concept of personal finance, we can break down personal finance into five main areas:

- Protection

- Income

- Spending

- Investment

- Saving

Protection

Protection here refers to the financial products and services that safeguard the individuals with unforeseen and adverse events. Financial products may include various life and non-life insurance schemes and financial services includes consulting and counseling for the financial options.

- Life Insurance

- Non- Life Insurance

- Estate Planning

Protection products also have tax significance i.e. financial products and their schemes assist in tax-savings for individuals.

Income

Income is the source of cash inflow for any individual working. Personal finance also assists individuals in properly managing such inflows so that they can make maximum utilization of income. Insurance decisions help in tax saving and ultimately assist with raised purchasing power. Income management is the starting point for financial planning and other areas of personal finance.

Some of the income horizons are:

- Salaries

- Bonuses

- Hourly wages

- Pensions

- Dividends

Investment

Individuals have some funds available with them, from savings or from borrowings, for making investment decisions. It also includes the decision made by individuals i.e. investment in various financial instruments. Personal finance utilizes the available idle funds and invests those funds for a good rate of investment. Investment is essential as it provides return on investment and helps the investors in minimizing future risk.

Incomes are generally used either in spending or in saving or in investing. Some of the most attractive investment horizons are:

- Stocks

- Bonds

- Mutual funds

- Gold

- Real Estate

- Commodities

Spending

Spending includes cash outflow i.e. expenses an individual incurs while buying goods and services or anything that is consumable (not capital investment). It shares a larger portion of the income we get. Spending can be done on a cash basis as well as a credit basis. Personal finance decisions are to minimize the unwanted or undesirable spending and allocate the income properly. Some of the common sources of spending are:

- Rent

- Mortgage

- Taxes

- Food

- Entertainment

- Traveling

- Credit card payment

Savings

Saving is simply retaining the excess funds for future investment or expenses. Individuals’ income has three dimensions i.e. spending, investment, and savings. Savings are the funds remaining after investments and spending. Personal finance guides individuals to different schemes to savings so that they can maximize the return from their excess funds. Common forms of savings include:

- Physical cash

- Various account schemes

- Checking bank accounts

- Money market securities

Personal Finance Planning Process

Personal Finance deals with some of the basic concepts of accounting and finance and hence it may seem that personal finance has easy terms to conduct. In reality, good financial decisions are hard to make as tradeoffs between risk and return or opportunity and threat is hard to make. The concepts of saving, investment, spending, income,e and protection can be managed and discussed under the same concept of Budget i.e. a formal financial plan. Budget or Personal Finance Planning can only be effective when all the evaluation are done in the best possible way and some of the main components for such planning are:

- Assessment

- Goals

- Plan Development

- Execution

- Monitoring and reassessment

Assessment

Assessment generally means stating the current position or situation financially or non-financially. This means evaluation or estimation of the present situation for better understanding the scenario. Assessment includes evaluation of income sources, expenses headings, investment avenues and other personal finance related options.

Goals

Goals refers to the objective of personal finance. We have already discussed the areas of personal finance. Here, we define our purpose for personal finance. This means, we make a commitment towards income, expenses, investment, savings and protection.

The division of income, managing expenses headings, selection of investment options, selection of saving schemes, etc. depends on the goals of the individual as their personal finance decisions.

Plan Development

Plan development is the execution phase of goal selection. Personal finance advisors suggest the possible options, schemes etc. as per the goal of the individual. Searching for the alternatives and analyzing and evaluating those alternatives for providing the optimal financial counseling is plan development.

Execution

Execution is adapting to the financial plan and policies that will lead to achievement of the defined goals. We invest in selected investment options, we try to manage our expenses headings, we select the best financial products etc. which optimize our financial potential and minimize our risk.

Monitoring and Reassessment

It is not always that we achieve what we have planned for. There are various overvalued and undervalued decisions and similarly, the changes in macro environment influences our made decisions. Monitoring is the controlling function to check and balance such uncertainty.

If the failing decision can be reassessed then we go for changing or reassessment and try to select another set of alternatives and options. Eventually, the main objective is to have optimal financial decisions and minimum financial risk.

References

1 thought on “Personal Finance”