Introduction

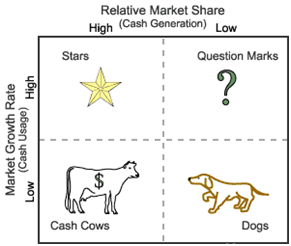

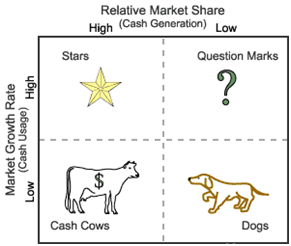

BCG Matrix is a four celled matrix ( 2*2 matrix) developed by Boston Consulting Group, USA. It is a widely used corporate portfolio analysis tool. BCG matrix provides a graphical representation for an organization to examine different businesses in its portfolio on the basis of their related market share and industry growth rates. It is a two dimensional analysis on management of SBU’s (Strategic Business Units). In other words, it is a comparative analysis of business potential and the evaluation of the environment.

According to this matrix, a business could be classified as high or low according to their industry growth rate and relative market share.

- Relative Market Share = SBU sales this year leading competitors sales this year.

- Market Growth Rate: Industry sales this year- Industry sales last year

The dimension of business strength, relative market share, will measure comparative advantage indicated by market dominance. The key theory underlying this is the existence of an experience curve and that market share is achieved due to overall cost leadership.

BCG matrix has four cells, with the horizontal axis representing relative market share and the vertical axis denoting the market growth rate. The midpoint of relative market share is at 1.0. If all the SBU’s are in the same industry, we consider the average growth rate of the industry. The midpoint is set at the growth rate of the economy when all the SBU’s are in different industries.

Fig: Product Life Cycle and BCG Matrix

The situation of the grid determines the quantity of resources allocated to the business units. The four cells of this matrix are stars, cash cows, question marks and dogs. Each of these cells represents a particular type of business.

MULTIPLE CHOICE QUESTION ON BCG MATRIX

Stars

Stars represent business units having large market share in a fast growing industry. They may generate cash but because of the fast growing market, stars require huge investments to maintain their lead. Net cash flow is usually modest. SBU’s located in this cell are attractive as they are located in a robust industry and these business units are highly competitive in the industry. If successful, a star will become a cash cow when the industry matures.

Characteristics of Star category

- Stars category has high market share in high growth market.

- The products or business experience strong growth in the market

- Stars require heavy investment to sustain and enjoy the benefits

- Stars are the leaders in their business category

- Stars are future cash cows if they can manage when market matures

Cash Cows

Cash Cows represents business units having a large market share in a mature, slow growing industry. It requires little investment and generate cash that can be utilized for investment in other business units. These SBU’s are the corporation’s key source of cash, and are specifically the core business. They are the base of an organization. These businesses usually follow stability strategies. When cash cows lose their appeal and move towards deterioration, we pursue the retrenchment policy.

Characteristics of Cash Cows category

- Cash cows have higher market share in low growth market

- They have stable operation to generate sustainable revenue

- Comparatively low investment is required to generate revenue as demand is stable.

- The business are in profitable position.

Question Marks

Question marks represent business units having low relative market share and located in a high growth industry. They require a huge amount of cash to maintain or gain market share. They require attention to determine if the venture can be viable. Question marks are generally new goods and services which have a good commercial prospective. There is no specific strategy that can be adopted. If the firm thinks it has a dominant market share, then it can adopt an expansion strategy, else retrenchment strategy can be adopted. Most businesses start as question marks as the company tries to enter a high growth market in which there is already a market-share. If ignored, then question marks may become dogs, while if huge investment is made, and then they have potential of becoming stars.

Characteristics of Question Marks category

- Question marks have low market share in a high-growth market.

- Future remains questionable

- Business/unit operates in high growth potential

- Requires intensive resource for market domination

Dogs

Dogs represent businesses having weak market shares in low-growth markets. They neither generate cash nor require huge amounts of cash. Due to low market share, these business units face cost disadvantages. Generally, retrenchment strategies are adopted because these firms can gain market share only at the expense of competitor’s/rival firms. These business firms have weak market share because of high costs, poor quality, ineffective marketing, etc. Unless a dog has some other strategic aim, it should be liquidated if there are fewer prospects for it to gain market share. Number of dogs should be avoided and minimized in an organization.

Characteristics of Dogs category

- Low market share in slow growing industry

- Dogs have limited growth perspective

- The product or service is in a declining phase

- No additional investment is made at this stage

Limitations of BCG Matrix

The BCG Matrix produces a framework for allocating resources among different business units and makes it possible to compare many business units at a glance. But BCG Matrix is not free from limitations, such as-

- BCG matrix classifies businesses as low and high, but generally, businesses can be medium also. Thus, the true nature of the business may not be reflected.

- The market is not clearly defined in this model.

- High market share does not always lead to high profits. There are high costs also involved with high market share.

- Growth rate and relative market share are not the only indicators of profitability. This model ignores and overlooks other indicators of profitability.

- At times, dogs may help other businesses in gaining a competitive advantage. They can earn even more than cash cows sometimes.

- This four-celled approach is considered to be too simplistic.

Example:

| Product Line | Question Marks | Start | Cash Cows | Dogs |

| Coca Cola | Fanta/Sprite | Thumps/Maaza | Coca Cola/ Limca | Diet Coke |

| Google Pay | YouTube | Google Search Engine | Orkut |

References